To maintain exposure to the Chinese economy but yet diversifing across various industries, I have reduced my stakes in Wei Yuan/YZJ Finance/ICBC and spread across more companies due to a deep discount scenario during Nov arising from the communist party blunder in their management of lockdowns.

Added Xiaomi, Nanofilm, ISDN, Huya & PRIME US REIT. The first 4 had experienced a sell down due to the Communist Party Congress bearing bad market sentiments with the Poliburto promotions and China's strict lockdowns despite citizens protest.

I am banking on China to reopen and with that an uptick in its manufacturing capacity. Nanofilm and ISDN are companies I think that will benefit. Xiaomi's investment is due to anticipation that China consumers will spend more on electronics and lifestyle products once their disposable income returns. Huya is for its advertising revenue and exposure to the younger China demographic segment who have been hard hit with youth unemployment at 19.9%. The antiicpation is that a reopening will reduce youth unemployment and increase in their dispoable income.

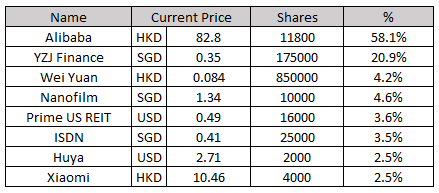

PRIME US Reit is unique as it is the only stock with US exposure to my otherwise heavily China focused portfoilo. Prime was picked because of an anticipated dividend yield of 12%. Below is my portfoilo composition:

No comments:

Post a Comment