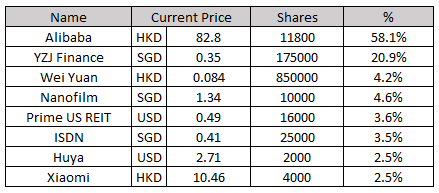

Currently, the SGX listed US REITs have been sold down terribly. In terms of dividends and price book, they are trading at very low valuations. Just look at the dividends and price to book ratio of PRIME and Manulife as of today (28 Dec 2022), these are distressed level pricing:

Prime REIT- P/B 0.47, Dividend Yield 17%

ManuLife REIT- P/B 0.43, Dividend Yield 15%

In the US exchange listed REITs, many are trading at price to book ratios of 0.9-1 times. This makes it baffling for the above 2 to be selling at such low values.... unless we retail investors are kept in the dark about some things.

Potential Red Flag of the REIT Managers

One thing that worries me is how both managements are not doing a share buyback when they are valued at a 50% discount to their property valuations. The REITs are afterall a portfoilo of properties and at such a discount, REIT managers would have deemed it attractive to be a good buy.

The lack of action by the management shows that either the REITs are short on cash or that they are anticipating a large writedown in property value of a magnitude greater than 20%. These would be terrible situations that the managers are not revealing. For context, a smilar US REIT called Digital Core is buying back its shares during this sell down at the 0.6-0.7 Price book value. Hence, it is no surprise this particular REIT has outperformed the other 2.

REITs are generally asset-heavy, financially engineered and pay out most of their earnings, leaving little cash on the balance sheet. So it is interesting to see a REIT using precious cash to start a share buyback. It demonstrates the capbility of Digital Core REIT manager unlike PRIME and ManuLife who have been silent on the scene.

I am particularly worried about the actions of both PRIME and ManuLife. The US REIT space was recently hit by a bad egg in 'Eagle Hospitality Trust' and people are afraid to invest in the space; yet these 2 REIT managers are not doing constructive actions to improve the sentiments, despite having better reputation and experience than the demised REIT manager.