While we hear about an environment of increasing interest rate, the surprise is that the Singapore Savings Bond (SSB) and pherhaps, T-bills interest are falling!

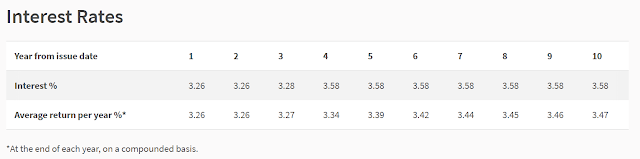

Just look at this month's SSB yield offer (3.26%) vs the previous month's (3.47%):

December SSB

November SSB

The magnitude of decrease is similar to what we saw in T bills in which it has fallen from 4% to 3.9%. For those who are still cash rich and have not been successful in T bills application, my personal feel is that we can try applying for the upcoming December T bills application; if bidding under the competitive allocation, the advice is to bid at about 3.5% (my gut feel is that the cut off rate for the December tranche of T bills will be at 3.8%)

After which whatever amount it fails, the fall back plan is to apply for December's SSB.

Will SSB and T bills rate continue to fall?

My suspicion is that most of the application we are observing for T bills are from CPF OA balance. As long as CPF OA maintains at 2.5%-3.0% interest, CPF members will continue to apply T bills. Due to the abritage, I suspect T bills rate will eventually be at 0.6% above the CPF OA rate (hence if CPF OA = 2.5%, T bills will be at 3.1%)

For SSB, as they are not CPF OA eligible, their rates are dependent on the excess cash that people have. Hence I suppose we will not see a much further decline in SSB rate. The Dec SSB rate is probably the equilibrium.

No comments:

Post a Comment