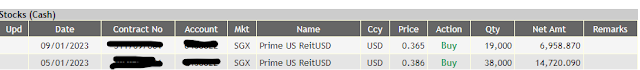

Following from my thoughts about my write up on the SGX Listed US office REITs and the subsequent drop in share price of PRIME, I have increased my stake in US PRIME.

Due to the large price decrease specifically for PRIME, the reit is now sporting an estimated dividend yield of 14% (provided there are no sudden large decrease in occupancy). Hence I have increased my stake 16k to 73k shares. As many of my other investments do not provide dividends (only share buybacks), it offers me a chance to have an overall portfolio with dividends.

Do take note US office REITs have a certain degree of risk because they are teetering on breaching MAS's regulatory limit for leverage ratio due to a higher risk free rate and declining occupancy for their properties. Hence there is a need to keep cash aside in case there are rights, I will be using the upcoming USD 3 cents dividend per share for this contingency.

Alphabet Purchase

I have started looking towards USA and my first purchase on the US tech is Alphabet at a price of USD$89.50. Alphabet was chosen as it is one of the rare companies with a strong moat in the online search engine which in turn fuels online advertising. I am awaiting the rise in Goggle's Pixel line of mobile phones as well. Should it be good enough to take away market share from the iPhone, it will increase Alphabet's market share in the mobile online search engine which will add runway to its revenue growth.

I expect Alphabet to continue growing its profits over the long term, 17x P/E for a company with considerable runway for profit growth has some degree of undervalue.

No comments:

Post a Comment