Shopify is a well known name in the e-commerce space for Canada and USA markets. It holds the number 2 spot in market share behind Amazon. Unlike Amazon, Shopify allows for its merchants to have customizable layouts for their e-commerce shops. Shopify earns from the subscription plans a merchant signs up to join its platform and the transaction fees for sales.

Verified Profitable Model

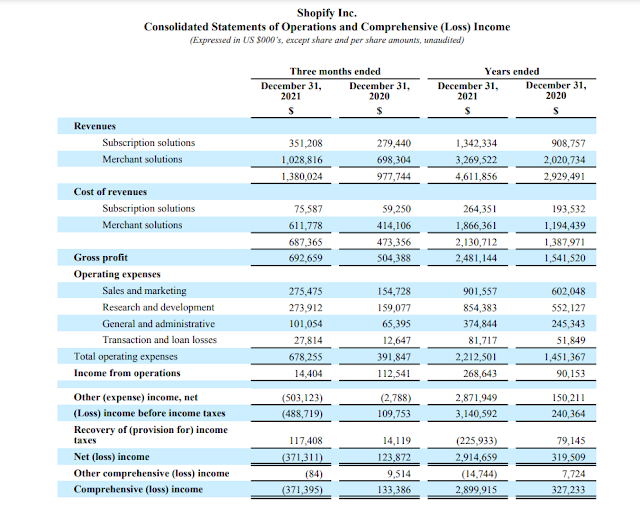

Unlike most start ups which promise growth and a large market share that can be monetized, Shopify has achieved this with an e commerce market share that is number 2, behind Amazon and is profitable in monetizing its user base. It achieved profitability in 2020, registering a core earning of US$90 million.

For 2021, its core profits tripled to US$268 million.

Shopify's FY 2021 results

How High can Profits Go?

I do not have a crystal ball but I will guess. With the post COVID-19 world, it is unlikely companies in the digital space will continue its blistering growth. I doubt Shopify can repeat a tripling of its core earnings this year; profits will grow by US$150 million to about US$400 million (55% growth).

Thereafter we will see a decade of 20-30% annual growth from growing revenue which will help profits, before an eventual plateau. This is because there is a limit to how much Shopify can take from Amazon in the growing e-commerce pie of the Western World and the inability to penetrate into China's market.

Risk to its Business

The entire Western World is now in an interest hike tightening environment due to inflation. The first order effect is that consumers are going to tighten their belt and spend less. This affects e-commerce spending growth.

The second order effect is a raising interest environment means it is more expensive for western countries to service their debts. Budget cuts may be inevitable which spurs less growth for the economy and in turn consumer spending.

In the short term, it is likely Shopify will announce US$2 billion in losses for its equity investments in other companies which it has marked up over the past 2 years due to the US market rally. The fear of interest rate hikes has wiped out most of the US companies equity gains.

Valuation of Shopify

Looking at FY 2022, I would expect US$400 million in profits. Followed by a decade of double digit growth of 20-30% with some downside in a changing monetary environment; a 90 times P/E to its core business earnings for FY 2022 is where I would invest. This is because I have to stomach a decade of risk that either the growth story does not materialize or a new entrant disrupts Shopify.

This values the company at a US$36 billion valuation. At current valuations of US$58 billion ($460 share price) or 145 times P/E, I think the market is baking too much optimism that Shopify will execute perfectly for the next decade. There is no margin of error. Hence, a further 40% of reduction of share price (US$276 to US$280) is warranted.

No doubt it is a company with a good growth story, but its current valuation is too high to justify it.

No comments:

Post a Comment