Sea Group has been sold down from US$370 on 20 October 2021 to US$87.62 on 22 April 2022. This is a 76% decline in share price.

Is this the end of the Sell Down?

The sell down in the past 6 months has been due to 2 reasons: (i) risk off behavior by investors due to interest rate hikes and quantitative tightening and (ii) companies failing to meet their own guidance or have growing losses.

The effects of (i) should be almost done, barring any surprises from the Federal Reserve such as a 75 basis point hike in May 2022. However what I am worried is Sea Group will report another set of poor results for 1Q2022 in June 2022.

Why a Poor Q1?

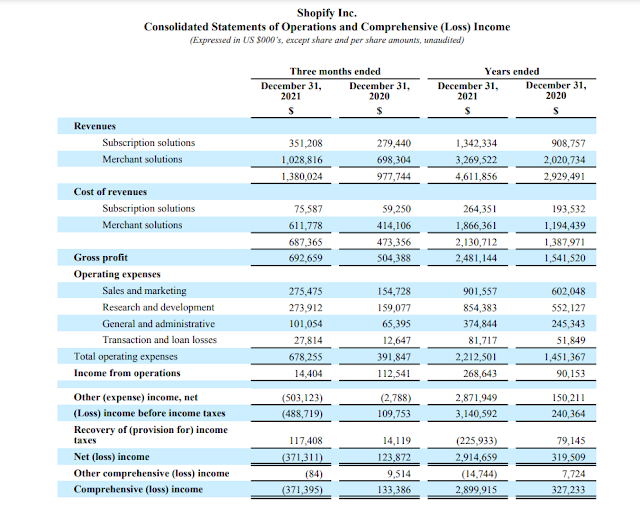

The growth of Sea's gaming arm has slowed as the popularity of Free Fire has plateau. In addition, while Shopee and Sea Money are growing, their losses are growing as well because these 2 segments are operating at negative margins. Hence, if Sea Group reports a loss that is of the same magnitude as Q1 2021, I expect another wave of sell down in June 2022.

Unless Sea Group provides an optimistic guidance that it is able to breakeven on an accounting basis in 2023, i doubt there is any other catalyst to move share prices up to its old highs. Given the current climate where investors are brutally selling off shares due to poor results and guidance, I expect Sea Group to suffer the same fate with its large losses. Investors will remember Sea has a few billion in bonds maturing in 2025/2026 and given its low share prices, bondholders will likely be redeeming in cash. This means Sea Group has to start putting in profitable quarters soon, otherwise a severe cash crunch is due in 4 years time if it continues burning billions in cash annually.

All in all, I expect another 25% fall in share prices, similar to what paypal experienced when it did not meet expectations. Sea Group is a prospect to look at after all the negatives are priced in. As mentioned in my previous post on Sea Group, my expectation is it has a valuation of US$95 (US$55 billion valuation). However, it is not a good time to buy now with prices offering too small a margin at US$87.62.