CPF Retirement Sum Topping Up Scheme (RTSU)

CPF RTSU is a scheme which allows us to make voluntary cash contributions into our CPF Special Account (CPF SA). The money goes into your SA which then grows over time.

If you like most Singaporeans have to continuously work to make ends meet, there is an extremely high chance that at age 55 (or later), you will be able to withdraw and enjoy the RTSU top up amount you have put in.

Benefit 1: High and Stable Interest

The CPF Special Account gives you 4% interest and is backed by the Singapore Government. In short, you are buying Singapore government bonds which continuously yields 4% each year that you can withdraw at 55 (or opt to continue holding post-age 55 to enjoy the 4% interest).

If you do an RTSU top up at age 25, its the same as buying a Singapore bond of 30 years.

In the current market, private investors have to accept a 1.3% interest yield when investing in a Singapore 30-year bond, however we as CPF Account holders get to enjoy a 4% interest ! CPF has never lowered the SA interest to be lower than 4% since 2000.

Even among banks, there is no bank that is offering such a high interest rate for their personal banking accounts or FDs (in fact many banks are lowering their interest rates for accounts)

Below is a comparison of Singapore Bond Yields vs CPF:

Benefit 2: Top up early and you will be in a much better position than others

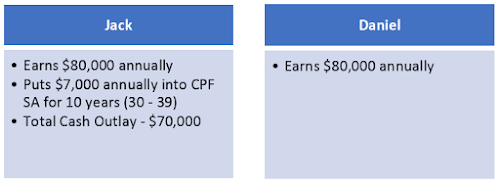

Let's create two hypothetical person in the world: Jack and Daniel. Both earn the same pay and progress the same; the only difference is that Jack puts in $7,000 annually in his RTSU from age 30-39. Here is the low down:

If both of them decide to work until 65 and only start to withdraw their CPF SA, the difference in their CPF SA balance is going to be huge.

At age 65, Jack has an approximate $220,000 head start over Daniel to enjoy for his retirement. This was due to Jack's decision to set aside $7,000 yearly from age 30-39 to prepare for retirement.

Benefit 3: Tax Savings in the Present

The first $7,000 you top up each year allows you to enjoy tax savings. This will be automatically filed into your annual income tax assessment.

However not Everyone Qualifies for it

CPF has an annual contribution limit of $37,740. Any money that you top up into CPF and exceeds the contribution limit will be refunded to you and you will not enjoy any of the above benefits. This means only those earning $100,000 and below annually can enjoy this.

In addition, if your CPF SA balance has exceeded the value of the current full retirement sum ($181,000 as of now); you will not be able to do RTSU.

Act on It!

Based on the above information, it is perhaps wise to start RTSU in your 30s to 40s. This is because if you start too early at the early 20s, your money is going to be locked in for a long duration of 30+ years. However if you do it too late at say age 50, there may be a chance that your CPF SA has exceeded the full retirement sum and you will not be able to top up or there is too short a time frame for your money to compound by leveraging on the high interest yield of CPF SA.

So plan your retirement and remember out there, there exists a scheme called the RTSU - available for many ordinary folks like us to act and take advantage of.

To read up more on this scheme, click on the link here (it leads you to the CPF website)

Hi CY,

ReplyDeleteWhile the CPF currently provides relatively high interest returns as compared to other savings instrument in the market, it is certainly not the only way to grow one's wealth.

If Daniel were to put his $7000 annually into some investment (say an ETF), it could well turn out that he would beat Jack hands down in terms of returns over a 35 year timeframe, and all this while receiving dividend payout!

I would say that the CPF is a good tool if you want to preserve your wealth like for example for people near retirement or already in retirement. For the younger people, the CPF may not be the best place to grow your wealth.

For my case, my wife and I used up almost all our CPF OA money to buy properties when we were younger and only in recent years, did we return all the money we used, including accrued interests back to our CPF OA. And I think our CPF amounts are not lower than those who have left their CPF money untouched all these years.

For its risk- reward profile, CPF SA is a very strong candidate. It has the risk profile of a Triple AAA rated bond but has a yield of 4%. It is very skewed and can function as your bond portfoilo.

Delete