This concept reminds me of constant conversations about how a car is a tool of convenience through saving time. So, I will be using a mathematical approach to show when owning a car in Singapore may make sense.

Cost of Owning and Maintaining a car

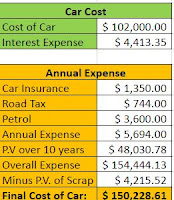

Firstly, lets find out the approximate expense of owning a car for 10 years. I used the price of a Toyota 1.6L as a gauge. Its current price is about $102,000. Next I estimated a down payment of 50% with the rest being financed by a car loan at 3% interest for a 5 years tenure. I also provided an estimate of the annual road tax, fuel expense and car insurance in the table below. As this is an annual expense which happens every year for the next 10 years, I applied a discount rate of 4% to get the present value (P.V.). Lastly, I estimated receiving a scrap value of $6,000 at the end of the 10 years and discounted it to present vale (P.V.) The below Excel shows the estimated present value of owning and maintaining the car over 10 years. This will be the amount we are spending to gain the extra time.

Figure 1: Finding P.V of annual expenses over 10 years

Figure 2: Total Expense of Car

Utility of Extra Time

Ask anyone on the street how much would they pay for an extra hour and a variety of answers will be obtained. Hence to avoid doing a sample survey, I will base it on "hourly wage" concept by dividing the monthly salary by 168 man hours worked in a single month. Hence, if someone earns $4,200 monthly (excluding Employer CPF Contributions), his perceived utility of earning an extra hour is $25 per hour ($4,200 divided by 168).

Next, I ask how much time is saved by commuting on a car than public transport. From my guess estimate of commuting to the city for work, I realize it is fair to say one saves about 30 minutes on a one way trip; so two ways will be 1 hour saved. And on Saturdays and Sundays, people will definitely use the car for easier commute. So in a year of 365 days, one person will have gained an "extra" 365 hours.

So in the current year, a person saving 365 hours and basing on a monetary value of $25 per hour, the person gains S$9,125 for the first year. As one will realize, the utility gained is over a 10 year time frame, therefore I will have to calculate the present value of this utility earned over 10 years.

Figure 3: P.V of Utility

Figure 4: Scenario of $8,400 monthly pay

Conclusion

I did some permutations and made two observations.

i) Income Level

If one is earning at least an estimated $50 per hour wage or $8,400 monthly, owning a car in Singapore alone is justified because the utility from the time gained is about the same as your overall expenditure on the car (owning & maintaining), see Figure 4.

ii) Ownership of a car if one is married or with a sibling

Of course, many of us do not earn $50 per hour (including yours truly!) However, if you are married or have a sibling who is working, mathematics will prove that earning $25 per hour justifies the reason to own a car in Singapore.

Figure 5: 2 person at $25 per hour wages

This simple Excel model has informed how the efficiency of the public transport system affects the ownership of a car to a large extent. In fact, with many Singaporean graduates already entering the workforce with an at least $3,000 monthly paycheck; it is likely a married couple's combined income level would have exceeded the $8,400 threshold having worked for a while- a tad worrying.

From this angle, it seems our transport and urban planners will have to accomplish much to reduce the travelling time by either increasing the connectivity of the public transport system or decentralizing commercial spaces.

The diabolical alternative is to reduce the wages of the people; to make them feel time is not that valuable 😈

I think you missed out annual expenses for parking, car inspection, routine maintenance and ad-hoc repairs (e.g. burst tyre, tow service). There are also major replacements that need to be carried out along the way - e.g. replacement of worn tyres.

ReplyDeleteAs far as time savings go, it depends on how accessible public transport is for your commute. In some cases, due to road traffic conditions, driving can actually take longer than public transport. Particularly if you are lucky enough to be able to go from train station to train station without the need for feeder bus.

Hi lizardo, accessibility is a very big factor and can cut both ways. Currently my workplace is not that accessible and I have to make a MRT line transit to reach harbourfront; as a result, it takes 1hr 15 mins from home to work. A car would have taken only 30 mins on normal traffic conditions.

ReplyDeleteHi Choon Yuan, I think for families the savings is even more. Bringing them out usually means to take a taxi in the weekends or sending them to school or infant care. Which is why I think it is justified for families to own a car! Good calculation to simplify things :)

ReplyDeleteHi Choon Yuan, I think for families the savings is even more. Bringing them out usually means to take a taxi in the weekends or sending them to school or infant care. Which is why I think it is justified for families to own a car! Good calculation to simplify things :)

ReplyDeleteCan I loan for COE only?

ReplyDelete