What has improved

Over the past 5 months, two significant events have occurred: Accredited investors have "naively" parted cash to buy 1) Keppel 8 year bonds at 3.725%, 2) Keppel REIT perpetuals at 4.75% and 3) Sale of a $160mil property by Keppel REIT. These events have improved Keppel and Keppel REIT's cash flow. It reduces the likelihood of a cash call from Keppel REIT.

What has worsened

The cratering of oil prices to below $30 is a major concern as majority of Keppel's customers are likely to delay their CAPEX plans, ask for a delay in delivery or even declare bankruptcy. This will affect Keppel's order book as evident by the significant decline in order book as of end Dec 15.

On the property front, Keppel's year end shows sales of China residential units are not moving well. Similarly, Keppel REIT is facing the threat of an office oversupply. Coupled with the payment of its new perpetuals, expect less dividends to flow back to the parent, Keppel Corp.

Financials

Net Gearing Ratio

Keppel's Net gearing has risen; so too has it gearing ratio. From its past 2 year's cash flow statement, Keppel's cash has been increasingly locked up in its working capital. This explains why cash is decreasing but borrowings have risen.

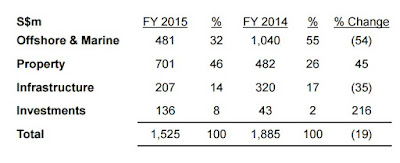

Furthermore from a segment analysis, one can see its O&M (a major contributor) is experiencing falling profits. While property profits have risen, it is a one-off event because it was due to Keppel buying over its non-controlling interest of KepLand.

Segment Analysis of Keppel's Profit

From the table, it seems Keppel is now depending on its property segment to sustain its profits.

Outlook in the different segments

O&M

Currently we are staring at an oil industry downturn. My view is that oil will stay below $50 for at least 3 more years due to the oversupply. This is because Iran and US are beginning to export their oil from 2016. As oil majors cur their capex, Keppel will not be getting much orders. However, its current order book of $9 Billion should keep its yards busy till 2018, but be prepared for lower profits in the region of s$300-350 Mil.

Property

While one is inclined to point to the fact that Keppel made s$700 mil in its property segment. It is important to note earnings of property coys are lumpy. It is important to differentiate between the recurring revenue (such as REITS fee) and those due to property development.

Keppel Land Profit breakdown (FY14)

In my opinion and from Kep Land's FY14 published results, only a small portion comes from fund management (55.8 mil profit was earned from fund management in FY 14), a significant portion comes from fair value gains of properties and sales of units in China and Singapore. Hence we must analyse the property market of these 2 countries.

Unfortunately, both China and Singapore are now experiencing slow growth and following from Keppel's quarterly financial results power point, sales of China and Singapore residential units have slowed over the year. It is likely moving on, revenue from property trading and investments are likely to fall. I expect only about $500 Mil of net profits coming from KC's property segment.

Investments

The investment segment comprises of mainly 3 companies: K1, KrisEnergy and M1. From these listed company results, it can be seen much of the increase in profits can be attributed to K1 ventures, who had recognized huge profits this year due to the selling off of many of its investments. It is especially visible in K1's latest quarterly results where profits jumped from 87.3 mil in latest quarter from 3.02 mil of the same quarter in previous FY. Such profits recognition are one-offs and are not recurring by nature. KC's investment segment may see profits reverting to normal levels from next FY, especially with m1 being unlikely to grow its profits by 20% and Kris Energy being mired in trouble.

Overall

All in all, it is likely KC's earnings will fall to s$1 billion next FY. While it is still a respectable figure, it still means a fall in earnings. At a current 9x forward P/E, Keppel is about fairly valued. I may start purchasing Keppel's shares when the price hits about $3.70 or about 7x forward P/E.

No comments:

Post a Comment