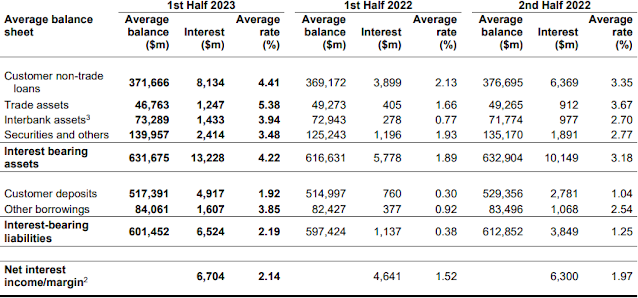

Looking at the first half of each of our local bank's financial statements, one thing stands out and that is DBS gives the lowest deposit rates to its depositers. This explains why DBS has been able to generate the largest annual profits each year among the 3 local banks. Evidence as below:

DBS Pays Depositers Average of 1.92%

OCBC Pays Depositers Average of 2.51%

UOB Pays Depositers Average of 2.51%

DBS Pays Depositors 0.59% less in Interest

Based on the above, it is obvious DBS pays about 0.6% less in deposit rates compared to OCBC and UOB. It is common knowledge that both OCBC's 360 account and UOB one account gives a better effective interest rate than DBS's multipler account as well. Somehow both OCBC and UOB pay the same amount of 2.51% interest rate while DBS is paying 1.92% interest rate.

Hence, it baffles me to why so many consumers still choose to bank their money with DBS, that is giving inferior deposit rates.

How Much is DBS Profitting more from Consumers?

This is not a made up number; DBS has $517 billion in customer's deposits. Giving 0.59% less in deposit means DBS saves $3.05 billion in interest to be paid.

That is equivalent to 4 months of its net profits. Partly due to its low deposit rates, DBS has been able to provide the lowest loan rates among loans.

Sensible Financial Move- Shift your money to Minimally OCBC and UOB

If you still prefer your money to be kept in a local bank, the financially wise move is to move your deposits to OCBC and UOB. Both banks are giving better rates than DBS. Even among the high yield saving accounts, OCBC and UOB is better than DBS.

For individuals who are depositing large amounts with DBS - Have fun Staying Poor

DBS is giving the worst rates among the local banks (and people know it). DBS shareholders and people who are taking low interest loan from DBS are profitting well from your lack of financial knowledge. I will like to take this opportunity to thank those who are banking a large chunk of money with DBS for contributing to DBS's dividends and building our Temasek's reserve!

DBS is a safer and stronger bank. Lower risk hence lower rate.

ReplyDeleteThis comment has been removed by the author.

DeleteFortunately, a few extra basis points of interest aren't going to be the difference between poverty and wealth. I don't qualify for the higher tiers of bonus interest for the various high interest savings accounts but that's fine with me, my bank account is for the parking of very liquid funds. I even have a low interest chequing account which I guess I should close soon, but last time I had a use for cheques. For higher interest rate savings, I have my SSB and T-bill ladder.

ReplyDeleteIn terms of being a digital bank and rolling out enhanced digital experiences, DBS has a big lead over the other local banks. Those in IT will know about the relative IT capabilities (or lack of) of the 3 local banks. Long time ago, my main bank shareholdings were in OCBC and UOB. However, when I learnt about DBS' digitalisation push, I'm glad I onboarded and took a position in DBS shares as well, it has been a rewarding journey :)