A year ago, I initiated coverage of YZJ Finance, a spin off from the shipbuilding company. In a sentence, it is a company holding a portfolio of investments across bonds, shares and loans. Its current investments are mainly in China and some in Singapore.

Summary

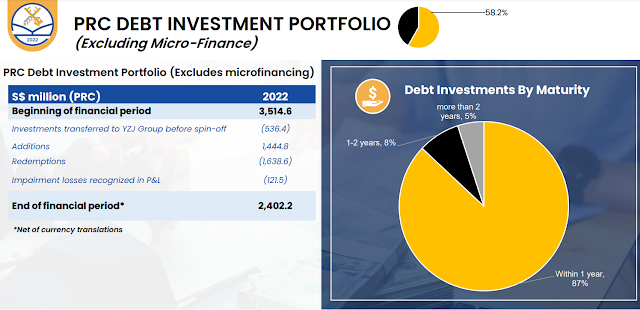

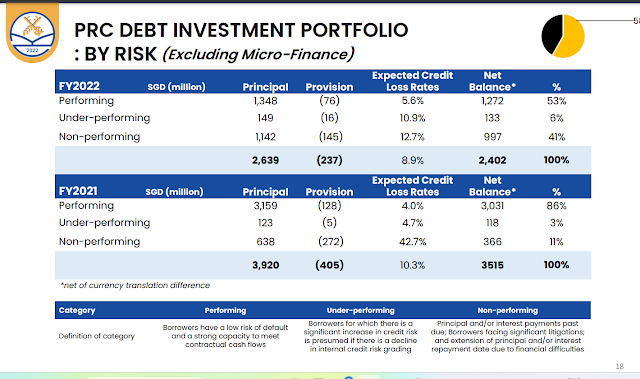

- Investment Portfolio of $4.1 billion earning $300 million in income (7.5% returns)

- Market Cap is only $1.35 billion means market is valuing it at one third its investment value

- Company can do share buyback as it is lowly valued and has the cash resources but is doing it very slowly

Below is my review of the latest full year financial results. For full reference of the financial health, performance and outlook of the company, please refer to its presentation which i find is comprehensive.

What Makes up YZJ Finance $4.1 Billion Portfoilo?

Dividends and Net Income

The company has a dividend policy where 40% of its net profits will be given as dividends.

In FY 2022, due to numerous poor performance in the VC sector and write down in debt instruments, the results were terrible marking a 20% decline in income

The company has guided to reduce its debt investments in China from 59% to 30% by the end of this year. To me, this is good as it means taking less risk. However, I wonder if the execution will occur given how bad the Chinese credit market is; to reduce by 29% means YZJ Finance will redeem SGD $1 billion worth of debts. Given how difficult it is to redeem China money, I am quite sure the Management will fail to make it happen and come up with reasons again.

What I Hope to Happen

Besides hoping for better financial results, I sincerely hope the management conducts a more thorough share buyback. Previously it bought back only 6.6% of shares in its last year share buyback.

Large Share Buyback

Given the large cash hoard and impending SGD$1 billion redemption, the company could do a $134 million share buyback, which maximises its 10% mandate as the entire mandate utilises only 8% of its enlarged cash holdings.

In recent days, the buyback has been slow. A share buyback will mean shareholders obtain a 300% return based on its declared investment value. YZJ Finance's management has to be honest about its investments. On one hand, the market thinks most of the company's investments has soured, while on the other, the management has constantly assured the market it is not.

A good way to assure is by doing a share buyback, while the management has constantly done this, the amount of share buy back done is not evident and backing up the management's words. Much is left to be desired.

YZJ Finance could easily triple in value from its current market cap of $1.35 billion or $0.34 share price. Its generating a 7.5% return on its invesment portfoilo and has a large amount of idle cash. Its investment portfolio is still growing. What's left is for management to realise the value for shareholders.

If the management hires me as their investor relations head/ investing team, I would propose a large buyback to realise value. There is so much value to unlock in this gem and the company has the cash resources to do it; somehow a million dollar salaried investment team seems to be blindly missing the picture. Pay me half the pay and I can do a better job for shareholders : p

No comments:

Post a Comment