In Growth stocks, there is one in Palantir that I believe will start to be profitable starting from this year. My view is that it will eventually become a 2 billion profit generator company and at a valuation of 40 billion, it will be a fair price.

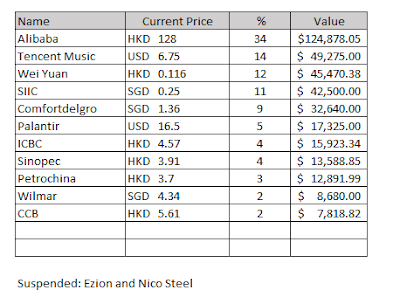

In terms of China weightage, I am at about 70% but spread across many industries of banking, e-commerce, music streaming, oil & refining, utilities and food produce (in the form of Willmar). The entire portfolio has a dividend yield of 2.3%, but this is skewed as the top 3 of my portfolio do not give dividends

Singapore Reopening Theme

As Singapore starts to reopen, there are 3 sectors I am looking at- tourism, transport and property/construction. "Tourism", I am looking at SATS but I am unsure if the upside is worth the risk because it seems the market has priced it at reopening levels, assuming returns to normalcy with a yield of 17 cents annual dividend; at $3.90, the dividend yield is already below 5%

Among the "Transport", it is a choice between ComfortDelgro (CDG) and Grab. Both look set to benefit with Singapore opening to tourism and foreigners which translates to more rides demanded especially from airport to other locations. I chose CDG as it has other profitable arms in Vicom, SBS Transit, driving schools.

The change in CDG Taxi CEO in my view is a positive because the previous CEO had performed badly in the face of competition from Grab and Gojek. The pricing of CDG's ride hailing app has been dismal where it is priced higher than Grab, despite CDG taxi model already profiting from drivers renting their taxis. If CDG could tweak its pricing correctly for its ride hailing app and given that its meter fares for street hailing is presently priced cheaper than ride hailing fares, CDG has the potential to take back a significant market share from these tech unicorns. CDG's other subsidiaries will also grow their profits back under the reopening theme. With the conglomerate still profitable and has a good dividend policy, I see it as a good stock to buy for now. I presume CDG will return to its 9-10 cents dividends dished out, which indicates a future yield of 6.6% at current prices.

"Property/Construction"- Public sector projects are being dished out and more foreigners are now able to enter for work with freedom to travel for short trips on VTL This leads to increased housing demand. Enough said. Companies I am looking at are KSH, Hock Lian Seng and Oxley. Boustead Singapore is another I am looking at having divested from it recently. Yongnam, while it is one of Singapore's largest steel strutting/construction company, is a no-go to me. They are bidding for projects below cost and are in a real danger of folding as evident by their balance sheet and cash burning ways.

Beyond Singapore

I am still looking at Chinese bank stocks mainly the big 4 of ICBC, CCB, ABC and BOC. However, further investments in them is not guaranteed. Yangzijiang and Tianjin Pharmaceutical are other companies that have attracted my interest due to its high dividends and strong business profits. The 3 china oil majors are also candidates

I don't see much value in many companies outside of these 2 countries.

No comments:

Post a Comment